Materiality Analysis

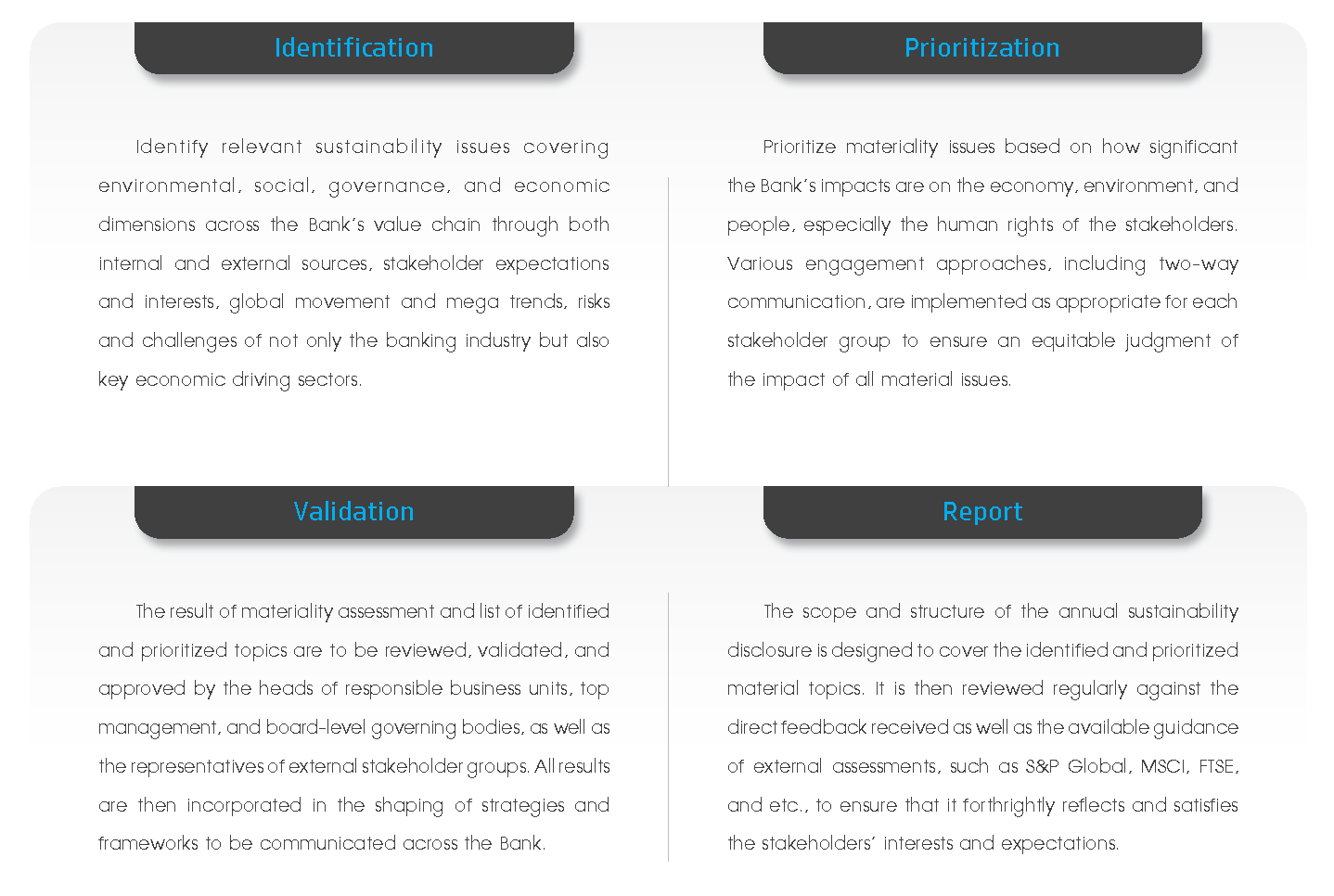

Materiality assessment mechanism enables us to make sense of the sustainability landscape we are in and also provide a powerful mandate to prioritize and act on topics that are the most critical for the Bank’s stakeholders, which in turn would sustain the Bank’s long-term growth. With reference to the framework of the Global Reporting Initiative (GRI) Standards, we designed our materiality approach to comprise of the following four main steps, which are revisited in order in each reporting cycle.

Materiality Matrix

Several contextual changes are found to affect the focus on each sustainability issue, such as the recovery dynamic of the post-pandemic market, the uncertainty in global economy and politics, technological and digital transition, rising concerns on data privacy and cybersecurity, and the more imminent impact of climate change on environment and humanity, which lead to consumers’ awareness and behavior shifts towards choosing greener options. As a result, this year’s materiality matrix significantly differs from the previous year’s due to the GRI Standards guideline revised in 2021. The impact that the Bank has on the economy, environment, and people in terms of each material aspect was considered and classified into 5 levels of importance. The stakeholders are encouraged to consider all-round impacts, whether they have already occurred or have yet to occur, positive or negative, intentional or unintentional by the Bank, and short-term or long-term.

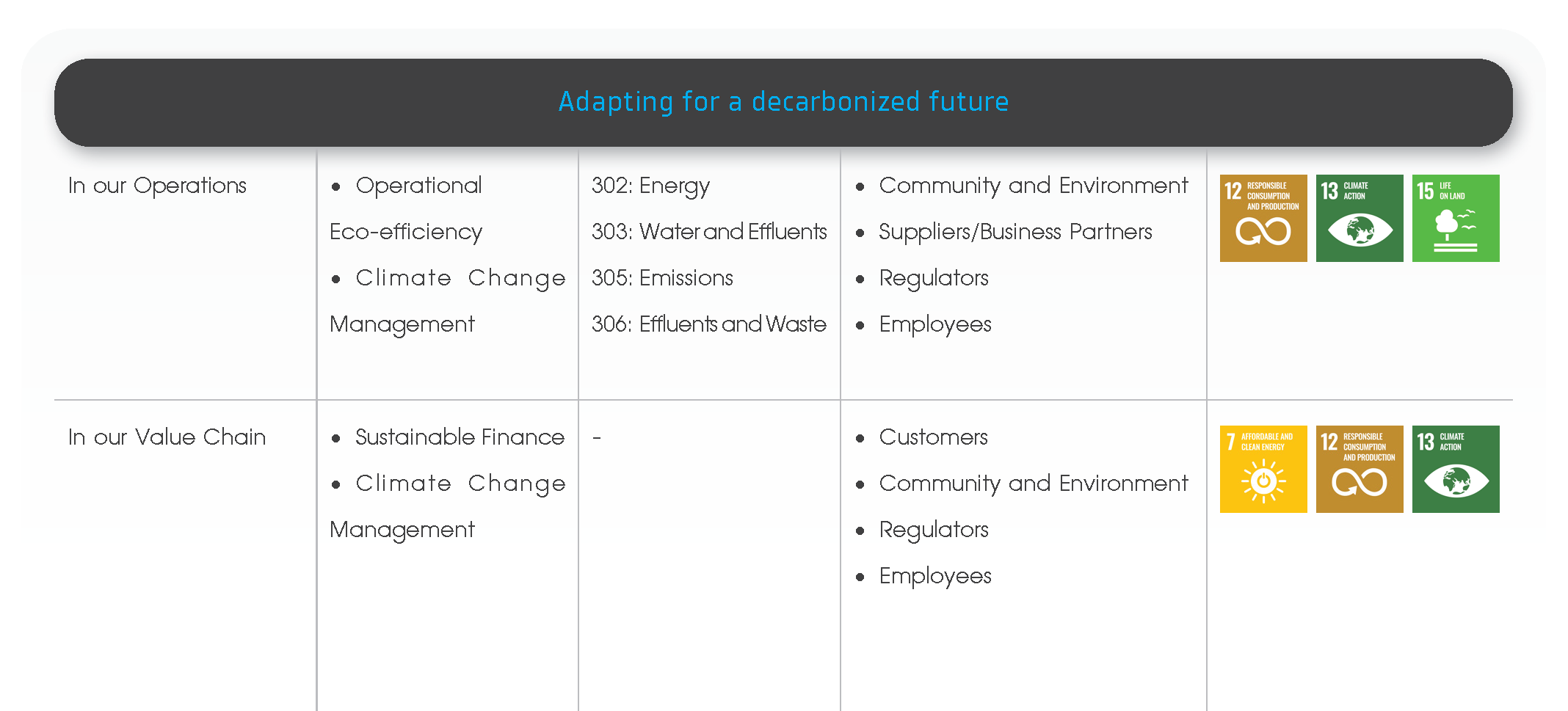

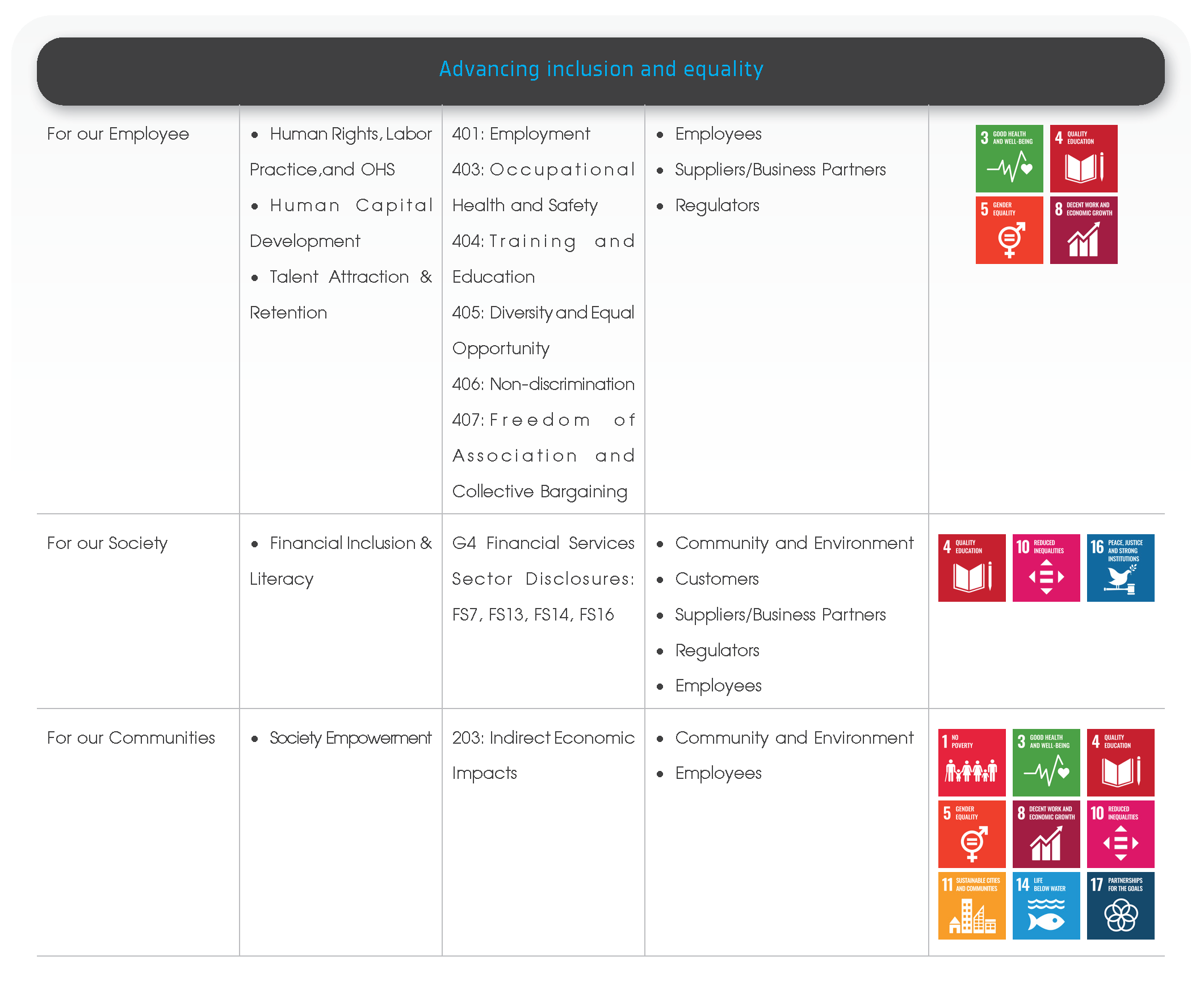

List of Material Topics

Several contextual changes are found to affect the focus on each sustainability issue, such as the recovery dynamic of the post-pandemic market, the uncertainty in global economy and politics, technological and digital transition, rising concerns on data privacy and cybersecurity, and the more imminent impact of climate change on environment and humanity, which lead to consumers’ awareness and behavior shifts towards choosing greener options. As a result, this year’s materiality matrix significantly differs from the previous year’s due to the GRI Standards guideline revised in 2021. The impact that the Bank has on the economy, environment, and people in terms of each material aspect was considered and classified into 5 levels of importance. The stakeholders are encouraged to consider all-round impacts, whether they have already occurred or have yet to occur, positive or negative, intentional or unintentional by the Bank, and short-term or long-term.