Corporate Governance

Good corporate governance practices are central to Krungthai’s culture and business conduct. As a financial institution, we prioritize this for several reasons. Firstly, it establishes a proper risk management framework, which is essential for stability and sustainability. Secondly, it promotes transparency, accountability, and responsible decision-making, building stakeholder confidence. Thirdly, it ensures compliance with laws and regulations, mitigating reputational damage and legal action. Fourthly, it enhances the bank's reputation, establishing it as trustworthy, reliable, and responsible. Lastly, it focuses on promoting long-term sustainability by focusing on creating long-term value for stakeholders rather than short-term gains.

Krungthai Bank places great importance on conducting its business with transparency, honesty, and fairness in accordance with the principles of good corporate governance. The Bank strives to be an efficient organisation with excellence in business, based on ethical responsibility, taking into account all stakeholders, and guided by ESG principles, which encompass Environmental, Social, and Governance considerations. The Bank’s corporate culture emphasizes non-corruption (through its Zero Tolerance campaign) and fair customer service (through its Market Conduct policies), which are concretely embodied in every operational process. Moreover, the Bank is committed to continued business development and aims to contribute to the benefit of society by reducing inequality and promoting sustainable growth across all sectors of society.

The Board of Directors places a high priority on adhering to the principles and guidelines of good corporate governance, while also integrating sustainability dimensions into the banking culture and operations. This approach ensures that the Bank’s business operations are managed efficiently, transparently, and reliably. Moreover, it encourages all directors, executives, and employees at all levels to comply with the corporate governance policy, which fosters a culture of good governance within the organisation and raises the Bank’s corporate governance standards to meet international best practices. By adhering to the CARPETS corporate governance principle, which serves as a guideline for the Bank’s executives and employees, the Bank is committed to its vision of “Growing Together for SUSTAINABILITY” and to becoming one of the leading banks that promote the sustainable development of society and the nation.

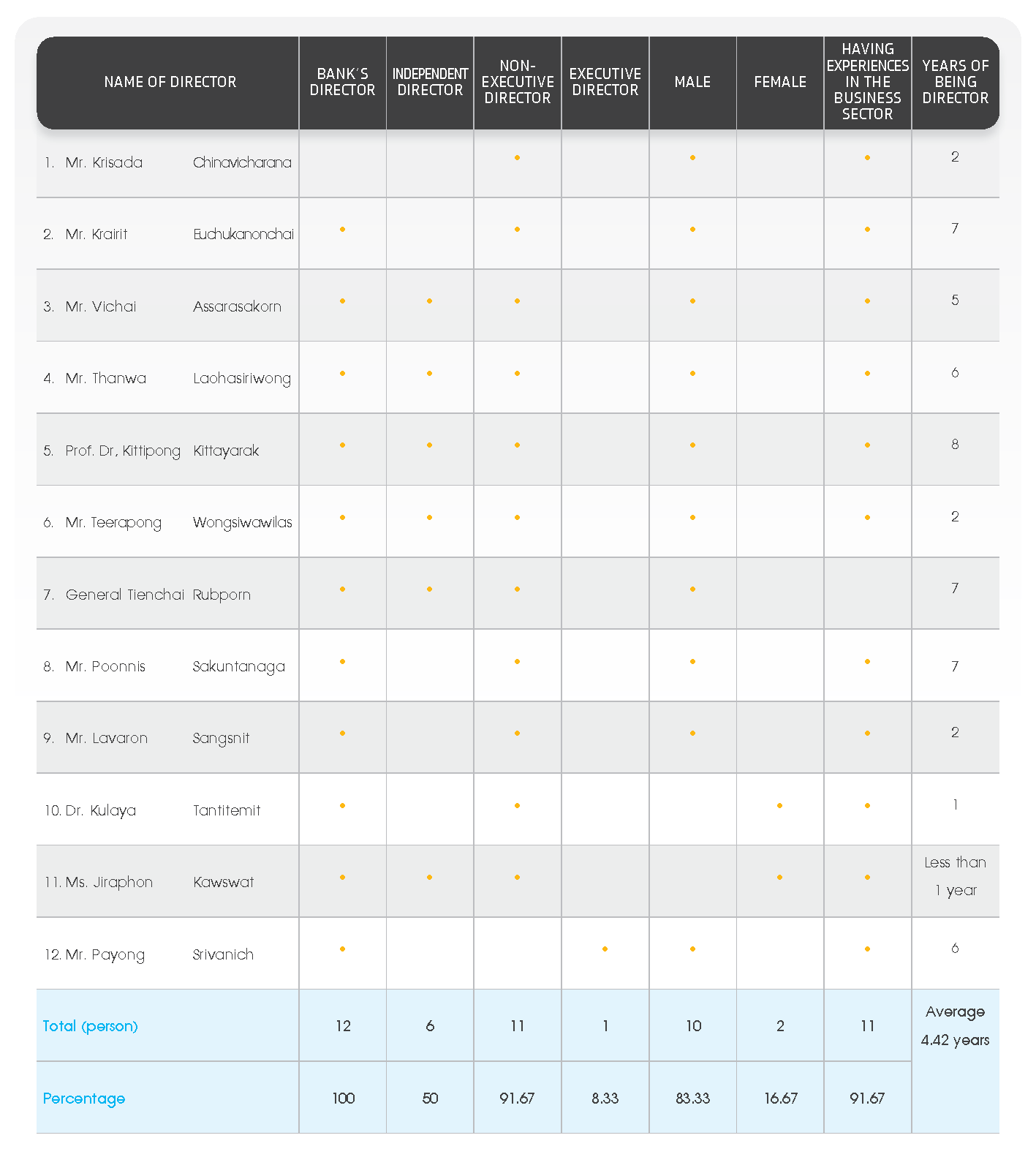

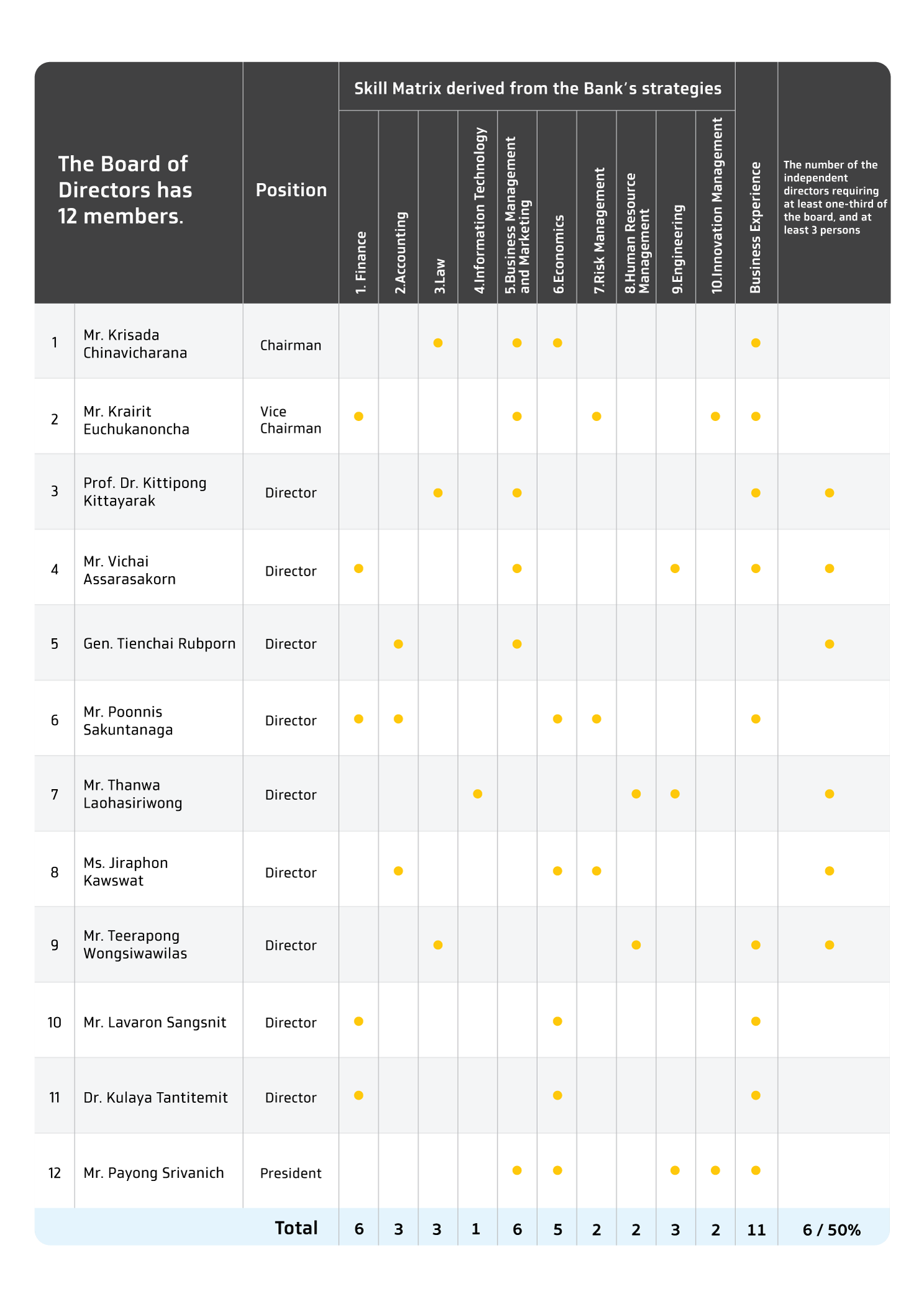

The Board of Directors currently consists of individuals who have undergone a nomination process conducted by the Nominating and Remuneration Committee, in accordance with legal procedures and good corporate governance principles. The process involves sourcing potential directors from various avenues, including a Director Pool, to ensure that the Board comprises individuals with the necessary knowledge and expertise that aligns with the Bank's missions, strategies, and sustainable development objectives, as defined in the Skill Matrix. The Board is comprised of individuals with diverse qualifications, skills, and experiences that are beneficial to the Bank, without discrimination on the basis of personal differences such as religion, culture, or gender. As of December 31, 2022, the Bank has 12 directors, of which one is an executive director and 11 are non-executive directors. Six of these directors are independent, which is equal to 50% of all directors. This exceeds the requirement of the Securities and Exchange Commission (SEC) that mandates at least one-third of directors to be independent but not less than three. Additionally, the Board of Directors includes two female members, which is equivalent to 16.67%.

Director Nomination Policy

The person taking the Director position shall pass the nomination procedures of the Nomination and Remuneration Committee as stipulated by law and good corporate governance principles. The proportion and composition of the Board of Directors are taken into consideration during the nomination process. The Committee considers candidates from various sources, including the Director Pool and nominations from shareholders. This is to ensure that the Committee nominates candidates with expertise that matches the required skill matrix derived from the Bank’s present and future missions and strategies, as well as sustainable growth. The candidates must not possess any of the prohibited characteristics as stipulated in the regulations of relating authorities and of the Bank. Therefore, the Board of Directors consists of a group of persons with diverse qualifications in terms of skills, experience and expertise that are beneficial to the Bank. The Board shall be composed of at least 1 person having knowledge or working experience related to the commercial banking business, at least 1 person in accounting and finance, and at least 1 person in information technology. Personal differences in religion, culture, ethnic, nationality, gender, age, etc. shall not be grounds for discrimination or limitation for holding the office of director. The Nomination Committee shall consider the qualifications of the Bank’s Directors as follows

- Must possess director qualifications as specified in the Public Limited Companies Act, Financial Institutions Businesses Act, Standard Qualifications of Directors and State Enterprise Employees Act, Securities and Exchange Act, Royal Decree Regulating on Electronic Payment Services, laws and regulations of the regulatory agencies related to the business operation and regulations of the Bank as well as no unreliable characteristic according to the notification of the Securities and Exchange Commission, Thailand.

- Have knowledge and expertise according to the skill matrix specified by the Bank which is derived from the Bank’s mission and strategy. Hence, the Board of Directors shall be composed of persons with diverse qualifications such as skills, experiences and specialized abilities. The Board of Directors must consist of at least one person with knowledge or experience related to commercial banking business, at least one person with knowledge or experience related to accounting and at least one person with knowledge or experience related to information technology.

- Able to perform duties, independently express their opinions, and dedicate sufficient time to perform duties.

-

Holding positions in other companies

- Holding a director or an executive director position in other companies in no more than 3 businesses.

- Holding a director position in no more than 5 listed companies in Thailand or abroad (including Krungthai Bank Public Company Limited but excluding companies from debt restructuring)

Board Skill Matrix

Remarks

- Expertise (at least 3 years’ experience in the field, specify only the two fields with most experience)

- Business experience means having at least 3 years of experience in private companies, state enterprises, or non-governmental organizations.

- The criteria are as stipulated in the Notification of the Capital Market Supervisory Board No. Tor Chor. 39/2559, the Notification of the Bank of Thailand No. Sor Nor Sor. 10/2561, and the Charter of the Independent Director Committee.

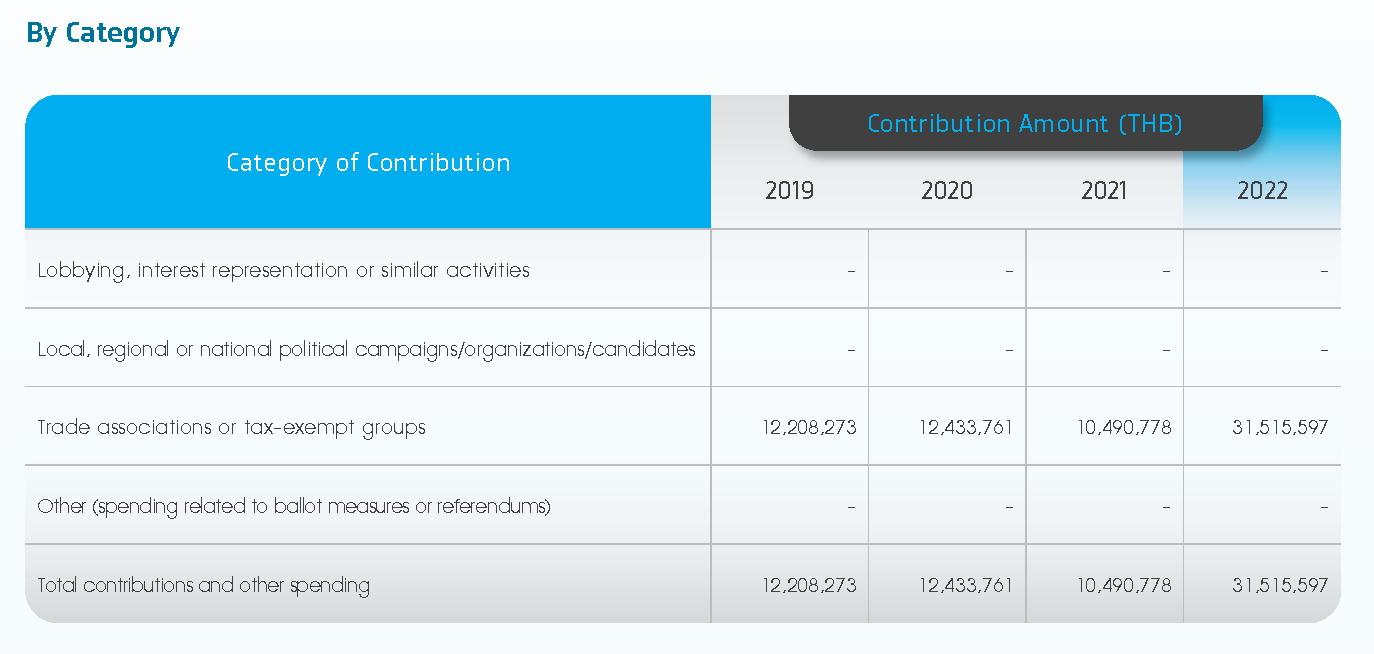

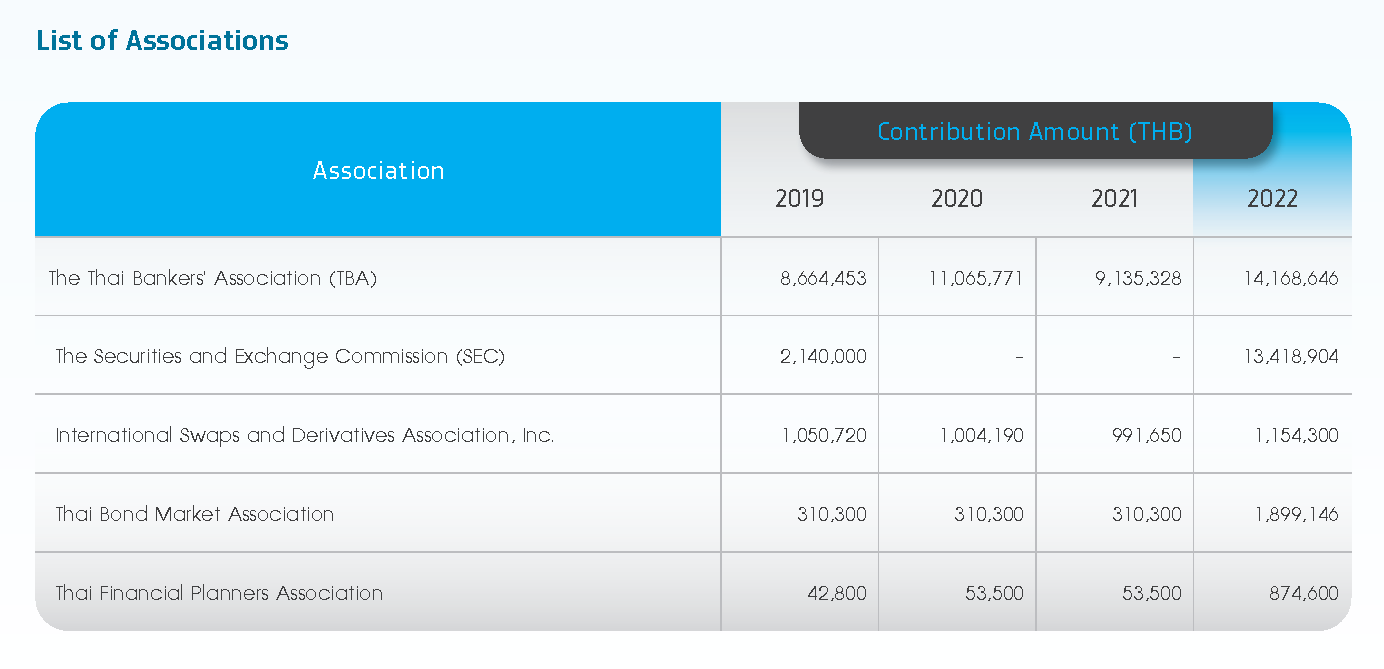

Contribution to External Organizations

Krungthai Bank has a clear policy, which is stated in the Bank’s Code of Conduct, to not provide financial support to or make contributions to political parties. In 2022, no contributions were made to support any political organizations or campaigns. However, we recognize that the bank and financial sector could collaboratively drive sustainability advancement at the industry level as well as enhance Thailand’s competitive edge in the global market. As the Bank considers the positive impact of supporting the sustainability-focused development of practices, policies, and regulations, we engage with banking associations and trade associations and transparently contribute to these certain groups in the form of membership fees, as shown in the figures below.